United Way of Logan County is now an accredited charity of the Better Business Bureau. The accreditation, achieved in February 2017, means United Way meets all 20 Standards of Charitable Accountability established by the watchdog organization. United Way is the first and only Logan County nonprofit to apply for and meet all 20 BBB standards. The standards evaluate a charity’s financial accountability, governance and oversight, effectiveness measures, and fundraising and informational materials.

"For years, United Way has taken great pride in being an efficient and effective steward of donor dollars," said Ben Stahler, United Way's Board President. "So we thought it was important to apply for the seal to add further credibility to our operations. It helps us show our community partners that we deliver what we promise. And it's not just us saying it, but the Better Business Bureau, a reputable resource on the side of consumers and donors.”

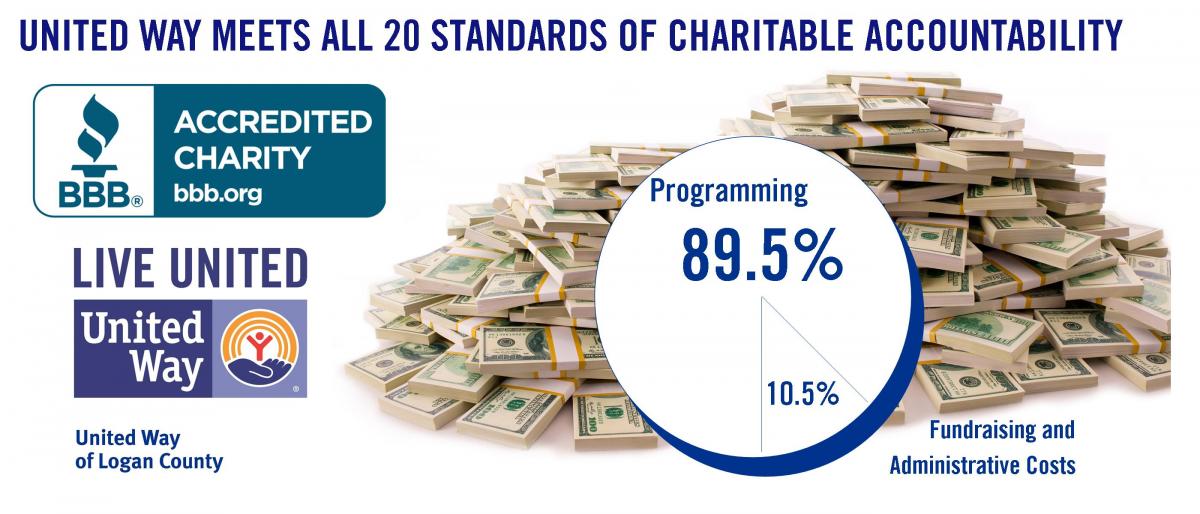

Perhaps of most significance, over the last three yearse, United Way has spent just 10.5 percent of its total revenue on overhead, with 89.5 percent going directly to programming, well surpassing the BBB standard of 35 percent to overhead and 65 percent to programming.

"Our Allocations Committee volunteers take their role of spending donor dollars seriously and are very conscientious about their funding decisions," said Dave Bezusko, United Way of Logan County's Executive Director. "So when you give to United Way, you can be sure that your contribution will be maximized to make the greatest possible impact, right here in Logan County."

To view the BBB's full report on United Way of Logan County, please click here.

The 20 Standards of Charitable Accountability include the following:

GOVERNANCE AND OVERSIGHT

The governing board has the ultimate oversight authority for any charitable organization. This section of the standard seeks to ensure that the volunteer board is active, independent and free of self-dealing. To meet these standards, the organization shall have:

1. Board Oversight - A board of directors that provides adequate oversight of the charity's operations and its staff. Indication of adequate oversight includes, but is not limited to, regularly scheduled appraisals of the CEO's performance, evidence of disbursement controls such as board approval of the budget, fund raising practices, establishment of a conflict of interest policy, and establishment of accounting procedures sufficient to safeguard charity finances.

2. Board Size - A board of directors with a minimum of five voting members.

3. Board Meetings - A minimum of three evenly spaced meetings per year of the full governing body with a majority in attendance, with face-to-face participation. A conference call of the full board can substitute for one of the three meetings of the governing body. For all meetings, alternative modes of participation are acceptable for those with physical disabilities.

4. Board Compensation - Not more than one or 10% (whichever is greater) directly or indirectly compensated person(s) serving as voting member(s) of the board. Compensated members shall not serve as the board's chair or treasurer.

5. Conflict of Interest - No transaction(s) in which any board or staff members have material conflicting interests with the charity resulting from any relationship or business affiliation. Factors that will be considered when concluding whether or not a related party transaction constitutes a conflict of interest and if such a conflict is material, include, but are not limited to: any arm's length procedures established by the charity; the size of the transaction relative to like expenses of the charity; whether the interested party participated in the board vote on the transaction; if competitive bids were sought and whether the transaction is one-time, recurring or ongoing.

MEASURING EFFECTIVENESS

An organization should regularly assess its effectiveness in achieving its mission. This section seeks to ensure that an organization has defined, measurable goals and objectives in place and a defined process in place to evaluate the success and impact of its program(s) in fulfilling the goals and objectives of the organization and that also identifies ways to address any deficiencies. To meet these standards, a charitable organization shall:

6. Effectiveness Policy - Have a board policy of assessing, no less than every two years, the organization's performance and effectiveness and of determining future actions required to achieve its mission.

7. Effectiveness Report - Submit to the organization's governing body, for its approval, a written report that outlines the results of the aforementioned performance and effectiveness assessment and recommendations for future actions.

FINANCES

This section of the standards seeks to ensure that the charity spends its funds honestly, prudently and in accordance with statements made in fund raising appeals. To meet these standards, the charitable organization shall:

8. Program Expenses - Spend at least 65% of its total expenses on program activities.

9. Fund Raising Expenses - Spend no more than 35% of related contributions on fund raising. Related contributions include donations, legacies, and other gifts received as a result of fund raising efforts.

10. Accumulating Funds - Avoid accumulating funds that could be used for current program activities. To meet this standard, the charity's unrestricted net assets available for use should not be more than three times the size of the past year's expenses or three times the size of the current year's budget, whichever is higher.

11. Audit Report - Make available to all, on request, complete annual financial statements prepared in accordance with generally accepted accounting principles. When total annual gross income exceeds $500,000, these statements should be audited in accordance with generally accepted auditing standards. For charities whose annual gross income is less than $500,000, a review by a certified public accountant is sufficient to meet this standard. For charities whose annual gross income is less than $250,000, an internally produced, complete financial statement is sufficient to meet this standard.

12. Detailed Expense Breakdown - Include in the financial statements a breakdown of expenses (e.g., salaries, travel, postage, etc.) that shows what portion of these expenses was allocated to program, fund raising, and administrative activities. If the charity has more than one major program category, the schedule should provide a breakdown for each category.

13. Accurate Expense Reporting - Accurately report the charity's expenses, including any joint cost allocations, in its financial statements. For example, audited or unaudited statements which inaccurately claim zero fund raising expenses or otherwise understate the amount a charity spends on fund raising, and/or overstate the amount it spends on programs will not meet this standard.

14. Budget Plan - Have a board-approved annual budget for its current fiscal year, outlining projected expenses for major program activities, fund raising, and administration.

FUND RAISING AND INFORMATIONAL MATERIALS

A fund raising appeal is often the only contact a donor has with a charity and may be the sole impetus for giving. This section of the standards seeks to ensure that a charity's representations to the public are accurate, complete and respectful. To meet these standards, the charitable organization shall:

15. Accurate Materials - Have solicitations and informational materials, distributed by any means, that are accurate, truthful and not misleading, both in whole and in part. Appeals that omit a clear description of program(s) for which contributions are sought will not meet this standard. A charity should also be able to substantiate that the timing and nature of its expenditures are in accordance with what is stated, expressed, or implied in the charity's solicitations.

16. Annual Report - Have an annual report available to all, on request, that includes: a) the organization's mission statement, b) a summary of the past year's program service accomplishments, c) a roster of the officers and members of the board of directors, and d) financial information that includes (i) total income in the past fiscal year, (ii) expenses in the same program, fund raising and administrative categories as in the financial statements, and (iii) ending net assets.

17. Website Disclosures - Include on any charity websites that solicit contributions, the same information that is recommended for annual reports, as well as the mailing address of the charity and electronic access to its most recent IRS Form 990.

18. Donor Privacy - Address privacy concerns of donors by: a) providing in written appeals, at least annually, a means (e.g., such as a check off box) for both new and continuing donors to inform the charity if they do not want their name and address shared outside the organization, and b) providing a clear, prominent and easily accessible privacy policy on any of its websites that tells visitors (i) what information, if any, is being collected about them by the charity and how this information will be used, (ii) how to contact the charity to review personal information collected and request corrections, (iii) how to inform the charity (e.g., a check off box) that the visitor does not wish his/her personal information to be shared outside the organization, and (iv) what security measures the charity has in place to protect personal information.

19. Cause Marketing Disclosures - Clearly disclose how the charity benefits from the sale of products or services (i.e., cause-related marketing) that state or imply that a charity will benefit from a consumer sale or transaction. Such promotions should disclose, at the point of solicitation: a) the actual or anticipated portion of the purchase price that will benefit the charity (e.g., 5 cents will be contributed to abc charity for every xyz company product sold), b) the duration of the campaign (e.g., the month of October), and c) any maximum or guaranteed minimum contribution amount (e.g., up to a maximum of $200,000).

20. Complaints - Respond promptly to and act on complaints brought to its attention by the BBB Wise Giving Alliance and/or BBBs about fund raising practices, privacy policy violations and/or other issues.

For more than 100 years, Better Business Bureau has been helping people find businesses, brands and charities they can trust. In 2014, people turned to BBB more than 165 million times for BBB Business Reviews on more than 4.7 million businesses and Charity Reports on 11,000 charities, all available for free at bbb.org. BBB Serving Central Ohio was founded in 1921 and serving 21 counties in Ohio, is one of 113 local, independent BBBs across North America.

It’s the mission of United Way of Logan County to facilitate successful agency partnerships that enable a safe, healthy, and caring community. More than just a fundraiser, United Way collaborates with businesses, non-profits, government, and civic organizations to help meet the social service needs of the community.